Webinar Overview

As retailers struggle to identify new technologies that will help combat the ever-increasing rates of consumer theft and shrink, many have turned to or are considering computer vision as a component in their solutions. From the evolution of self-checkout to identifying risk through suspicious behavior, retailers have found that technological efforts around customer experience and shrink are often at odds.

In this webinar, we discussed the adoption of computer vision within retail, how retailers are approaching computer vision, and explore how those early efforts are performing. We’ll start with a retail economic update, then reveal the results of the research from our latest study. We’ll close out with an exploration of key use cases retailers are adopting to address these issues.

Transcript

[00:00:00] Greg Buzek: Thanks for having us as part of your day to day for our webinar titled “Rethinking self checkout: can new breakthroughs in computer vision address the shrink problem?” I’m Greg Buzek. And today I’ve got Stef Damianakis. Sorry, I had it yesterday. They’re joining with us. And Lee Holman is going to join us here later.

Hey, thanks to Stef and Ultron AI for sponsoring today. They’re the ones that are making this content available. The study was done independently.

There the research independently as part of what we did with RIS News, and we’re presenting the results here with a targeted list. So as always, the chat is open, and we welcome you to tell us where you’re from. Hey, we got the NFL Draft coming up tomorrow. Who’s your team? Who do you think they should take?

Or if you’re into hockey, the playoffs have happened, NBA playoffs have happened. Tell us what you like there. We want to get the chat going and we want that to be interactive throughout the day for things there. As well a couple things here wanted to tell you in the handouts section.

Now you’ll see our next opportunity for these kinds of things is the The AI transformed supply chain. We have 11 different categories of solutions where AI is already impacting profit performance. That is available if you want to participate in that. And also, another thing, if you wouldn’t mind we are now going to be putting a lot more content on our YouTube channel there. Please do click that and join our YouTube channel. We’re going to take a lot of snippets from these webinars here. And the little pieces that we’ll be doing is shorts mostly, but we’ll have webinars up there. We’ll take pieces like the economic part of this one.

We’ll put it up there as a separate video so that can live longer. In and of it by itself there. But yeah, we’d welcome you to be a part of that. And thanks for that. So with that, we’re going to turn the cameras off and just start focusing on the content as we go forward today.

Economic Update: Retail Growth By Country

[00:02:01] Greg Buzek: So let’s start with the economic update.

I always like to start wide and then narrow it down. So in reality, let’s look at what’s happening around the world and things are improving around the world, if only slightly. We’re still generally below inflation below negative when inflation is factored in. In Germany has been in a, an actual retail recession for several months now.

With the exception of October that has been negative. The UK has been a little positive after being down several months there. France has been negative for the last 19 months. The Olympics can’t get there fast enough for France. Just try to boost retail spending. Spain and Italy continue to be really strong, but they are going to be facing some tough comparisons coming up in the spring with the U.S. Travelers last year bumping up their economy last year for things. The star is actually Poland right now. After being down for 10 of the last 13 months, their February, their retail sales were up 6.1%. And so what you see there is a box around Poland and several other boxes. Those are the economies that are outpacing their inflation rates right now. So it just shows you who’s growing around the world. Hungary is growing for the last two months after their longest recession going.

China is up 3.1%, but that’s a misnomer, because for China to not have layoffs or what’s going on in their economy they generally need to be up 6 percent there. So they’re about half of where they should be for things to happen there. India continues to be strong at 5 percent growth continuing to benefit from manufacturing moving away from China. They’re from the EU as well as the US, Japan strong and outpacing inflation. They were actually considering some stimulus packages there in Japan and that stimulated growth in and of itself talking about the need for stimulus there that’s growing. South Korea continues to struggle. Just barely positive there. What’s going on there? Aging population is being an issue. Vietnam’s the star there, 9. 2 percent growth benefiting once again from more manufacturing coming there and also skip down to Brazil as being the other economy that’s outstripping inflation for the sake of time. This is a boost as they’ve gotten the benefit of oil revenues that have boosted their retail sales.

Economic Update: Deeper Dive into Global Inflation

[00:04:30] Greg Buzek: Inflation around the world, the biggest news here is the US has the highest inflation now among the advanced economies, where it did not used to be that way. In the first half of ’23, we were actually lower than most other parts of the world the EU, but we are now outpacing the EU in inflation, and we’ll talk a little bit about that.

In the UK, it’s not just in the US where groceries went sky high. This shows you an example of the growth that. We’ve seen in prices here, so you basically, I don’t know what the latest exchange rate is. I guess it’s about a buck and a quarter. So you add a 25 percent to each of these prices on either side to give you a U.S. Dollar equivalent, but it shows you that in these core food prices, it’s not just in the U.S. where that has grown.

This is Canada. Canada had a peak inflation just like that. Certainly very much tied to the U.S. on things they’re running about 3. 1 percent with their March inflation rate, which is lower than the US by 0.4 points related to the inflation. So where we are today, the CPI at 3.5 for everything. And they break out this less food and energy. So you take the food out. So the food inflation is actually driving the inflation down, which is really fascinating when you consider what’s been happening.

So where is all that inflation?

As you’ll see here, it’s not in food. So it’s not food at home or food away from home. Anymore being the big driver, although food away from home in our restaurants continue to show growth there. It’s more to do with transportation services. It’s related to cars. It’s related to fuel what’s going on.

But most of all, it’s related to insurance, being the biggest driver, whether it is car insurance or home insurance. I think the average has been up anywhere from 40 to 60 percent in some locations for insurance rates there. So that’s really interesting when you start talking about the Fed and interest rates and what’s happening.

I always love Truflation and what they do, it’s more of a Nielsen rating, tracking the actual inflation rate here. And they peg this at about 2.09. So we’re actually at that 2 percent according to Truflation that the Fed is trying to target. The bigger challenge is where we were prior to the pandemic.

We’re up 25 percent overall over the last three years in pricing, and that’s reflected in a lot of different things. This just shows you a market basket looking at the grocery bill. As you can see, the impact on prices from where we were just a couple years ago, literally in March of 2020. So that would have been right when the pandemic was starting.

There, so you see the differences in prices and where they are. So on average, we’re looking at about 36 and a half percent increase in food prices in the US for some of those things, but it’s not just in the home, it’s also eating out. This is a chart that shows you the increase in rates.

This is now, this goes back to 2014 to be fair, but the menu prices. At retailers that so it’s twice as expensive today to eat at McDonald’s as it was 10 years ago, according to finance buzz here, but it shows you some of the growth rate and things like that. So fuel price is always important. It feels like fuel has been going up and up and up and up.

The reality of it, though, is we’re literally at the same place we were last year. At this time, it just seems worse because money’s a little tighter now than it was a year ago and And it seemed to happen very quickly for things there’s $3.67 nationally for fuel prices, always an important thing because every penny sustained for a year means about 2 billion dollars out of consumer’s wallets to do something else with.

The good news is hourly earnings is still outpacing overall inflation here. That makes it very tough. Still, though, when you’re talking about some of these big Shock events like the insurance rates that are happening in places like that. So let’s talk about trade real quick trade.

We still have issues with the trade routes that are driving prices up. Certainly. Everybody’s familiar with what’s going on in the Middle East and with some of the shifts there and some of the added cost associated with going around Africa instead of through the Suez Canal, people are less familiar with the fact that there’s a drought in the Panama Canal.

Which has required them to reduce by 50 percent the volume of ships that are going through the canal, which is adding increases to prices for each individual thing. All of these conspired in late January to greatly drop off the cost of sending a 40 foot container around the world that has started to mitigate slightly.

You’ll notice that the most expensive route here is Shanghai to New York here, which is running at about 4500 dollars for a container there, but the Shanghai to Rotterdam. Is it about 3000, but it was as low as 1, 000 if you look at October of 23. So it’s tripled in cost because of the Middle East conflict there.

And then you’ve got the the Shanghai to LA didn’t peak as much, but it’s still running at about a 1,500 more than where we were going back to December for changes there. So all of that factors into things of inflation. Potential issues there. I thought it was fascinating looking at this chart because it shows you the annual change on the right.

That’s what I’m most interested in on this chart is how these routes have increased in the last year, but it also fascinates me at how cheaper the ratio between going one way versus going another you see it’s between 4 to 5 times more expensive going one way then it is going the other as we send our empties back to the point of manufacture.

That being said, if you need shipping container for any purpose, it’s a good time to buy a shipping container out there right now because there’s a glut of them as a result of the shipping. Inbound cargo to the U.S.: The main thing I wanted to highlight here is if you look at where we were, where they’re projecting to be in August of this year versus August of last year.

We’re up about 20, is that about 20%? Maybe in terms of volume of cargo, which means our inventory situation at stores is not going to be as acute as it was coming into the holidays. This past year, retailers are expanding a little bit more on their inventories to make sure they’re available. At least this is what they’re projecting NRF and the global port tracker here.

Economic Update: Debt and Housing

[00:11:35] Greg Buzek: So let’s talk consumers now because this is where the rubber meets the road for what we’re talking about for retail and housing is the big one. And then, and just to give you some ratios of where we were January 20 versus February 24 we have 42 percent increase in the cost of a home. As well, you look at a 46 percent increase in the salary required to own a median priced home across the United States.

And that’s really important for retail in the sense that when people buy new homes, they spend to outfit those homes. So that affects your home depots, your DIYs, that affects your Home goods stores, all of those areas because that’s a big deal. So when you look at it a different way, this shows the average home or housing payment that was required from where we were in 2021 at below 1,500, we were about 1,400.

And now we’re running at about 23, 2,400 in January of this year. And now it’s 2,775 for the average home in our interest rates at 6.88 percent here as of April 14th. So that massive growth there in the price of the home and the appreciation of the home is a big deal for consumers. On that though, is we’ve got this issue where the number of homes out there is very low because everybody wants to stay in their home.

As you’ll notice in the bottom left, you can see the split of interest rates of mortgages and historically low there. And on average, there’s a 3.2 points of gap between your existing margin mortgage and what you can get if you want to move right now. So that makes it extremely tough. If you are in a situation of having to move, that makes it extremely expensive to get a mortgage and everything related to that as well. So once again, just like fuel, more that goes into the mortgage is less that goes into the retail store. We’re also seeing record high debt. For consumers passing over a trillion dollars there in 2023, and now we’re up to 1.13 trillion as of Q4 of 2023. That’s some tough news there. We’ve also seen an increase in delinquencies that is starting to happen there.

There’s actually a fifth data point here related to student loans, and not surprisingly, that has actually gone down. From 22 to 23, the number of delinquencies, the growth rate actually decreased with that as the administration has paid off those loans there for a lot of people. The unfortunate part is 75, excuse me, 78 percent of Americans live paycheck to paycheck.

I thought this chart was fascinating. I’ll let you dig into it more when you get the slides, but it shows you by income, what is causing the economic stress overall. And I think it’s fascinating to look at paying for family members as being a huge portion of of what’s going on there in terms of why the higher incomes are having to Go paycheck to paycheck for things.

But as well, the nonessential spending down at the bottom half here also show something. So I just thought it was fascinating to include in the slides here for stuff. But understanding that 78 percent or paycheck to paycheck when we have these big spikes, whether it’s insurance, whether it’s fuel prices or whatever, that once again impacts what’s happening there.

Now, some of the good news is that the the average return from the IRS this year is higher than it was last year, slightly higher. What are we about 150 bucks higher on average that is coming through. And from what I understand the interest rate, if you, The delay, the interest rate the IRS is paying this year is 8%, if I’m not mistaken, on the money.

It’s actually better to leave your money with the IRS right now than I think it is to put it in a savings account for something. So it’s that’s a pretty bizarre turnaround that we’ve got for that. But that’s some good news and some silver lining, so to speak, if the government owes you money.

Economic Update: Retail and Retail Sales

[00:15:55] Greg Buzek: So let’s talk now some narrow it down specifically to retail and retail sales, and then we’ll jump into the computer vision. You can’t divorce pandemic spending from what’s going on with inflation and much more nuanced in the EU here and in Eurozone overall there, we’ve got a little less than one and a half trillion from these four countries that was spent.

The U.S. Is a little different and I have to equate it to World War II. What’s really amazing to me, and I just pulled this up, in World War II, the U.S., we built 151 aircraft carriers, 350 destroyers, 297,000 planes, and paid salaries for 16.5 million men and service men and women for four years, and we spent 4.2 trillion. In pandemic aid, we spent 5 trillion. Let that sink in. We gave out more money than we paid on World War II. About 2.1 trillion of that went to retail and why that’s important. It’s getting closer to our topic for the day. We added as growth in 2021, all of India’s annual retail sales, we added its growth in 2021 and held that not only did we hold that in 22, we added the the whole year for the UK as growth there.

And in 2023 we increased three percent. Again, so how big is that? That is the equivalent of Poland’s annual retail sales that we added in 2023. So when we talk about technologies like RFID and computer vision, like we’re talking today, or AI, it’s how do you grow from here? We did that with 3 million fewer workers working in retail and hospitality.

So as we look at March, this is March numbers from the government that came out without inflation involved. This is with inflation included for that. You’ll see, especially hard goods, a home goods in particular, your DIY and electronics getting hit hard here because of the mortgage rates that are out there in a slowdown in homes for those things.

And your drugs and your cosmetics, the non CBD side of things. We’re starting to see a slowdown in categories with the cosmetics that have been booming for quite a while there. Alta said they were only going to be up 6 percent their sales and their stock got creamed. Some of the big categories that are outpacing inflation, grocery stores. There your health and personal care is still out pacing that believe it or not. Clothing and accessories: the sales growth in March was higher than inflation, and we’ve gotten a big bump back in the sporting goods side of things as a result of that. And, of course, pure play e commerce driving, driving things there for that.

Now we look overall, we’re up 3.7 for the year. Inflation adjusted, we’re up 1.4 percent for the year. Those are the numbers from the U.S. Government that are out right now. I think they’re inflated higher because this is a survey that’s been extrapolated to the entire population and in about 3 months, this gets corrected downward, usually. But that just gives you an idea of where we are with retail.

Computer Vision in Retail: Looking at Theft and Shrink

[00:19:18] Greg Buzek: So that brings us to our topic. And so thank you for putting up with 22 minutes or so of economic piece just to be a set to talk about our topic today. Are we there yet with computer vision? And basically, we’ve seen massive amounts of computer vision that’s been deployed, but there are improvements that need to be made, and we’re seeing some big impacts on things there.

So let’s start with that, which is the most obvious use of computer vision overall. The increase in store theft as reported by our companies. We had 206 brands and this was weighted for the larger guys. And when I say weighted to the larger guys, we wanted Walmart or Home Depot to act as Walmart and Home Depot, not Walmart equals Joe’s grocery store.

So when we did this, we looked at that that way. So our average was 12.2 percent growth. Our winners that we defined as 10 percent sales growth. Okay, or profit growth. Those are our winners in each of these categories for 2023. They saw considerably higher theft, even after you factor in the theft, they were still winners, 16.3%. And the profit winners were actually saw the highest amount of theft at 18.7 percent growth in that. And that’s driving some of these use cases.

And this isn’t a stat that’s not really politically correct because it could be certainly used for bias, but facial recognition, the retailers that are using facial recognition to, and sharing data between their LP organizations in particular, saw 74 percent less growth In consumer theft because they were able to identify somebody that was “on the list” so to speak, the “no shop zone” or the “no entry zone” as they came into the store, and as a result, were able to deploy their people and police officers as well to help prevent theft in that particular situation.

Retail Computer Vision in Self Checkout

[00:21:19] Greg Buzek: But despite all the news out there that self checkout and people are moving out, self checkout and all this sort of stuff, it’s not going away.

In fact, the winners were 50 times more likely to be using self checkout than those that were not using self checkout or did not use self checkout in that environment.

Prioritizing Inventory Visibility

[00:21:39] Greg Buzek: The other thing that we found is those people that prioritized inventory visibility is a major priority. So they had to choose from 12 different priorities.

What were your top five in there. The ones that rated inventory visibility is a one of their top five saw considerably higher profits and 96 percent higher profits expected in 2024.

Adoption of computer vision in Retail

[00:22:04] Greg Buzek: So we’ve got this state of the industry, so to speak, and we’ve got this rapid growth of computer vision.

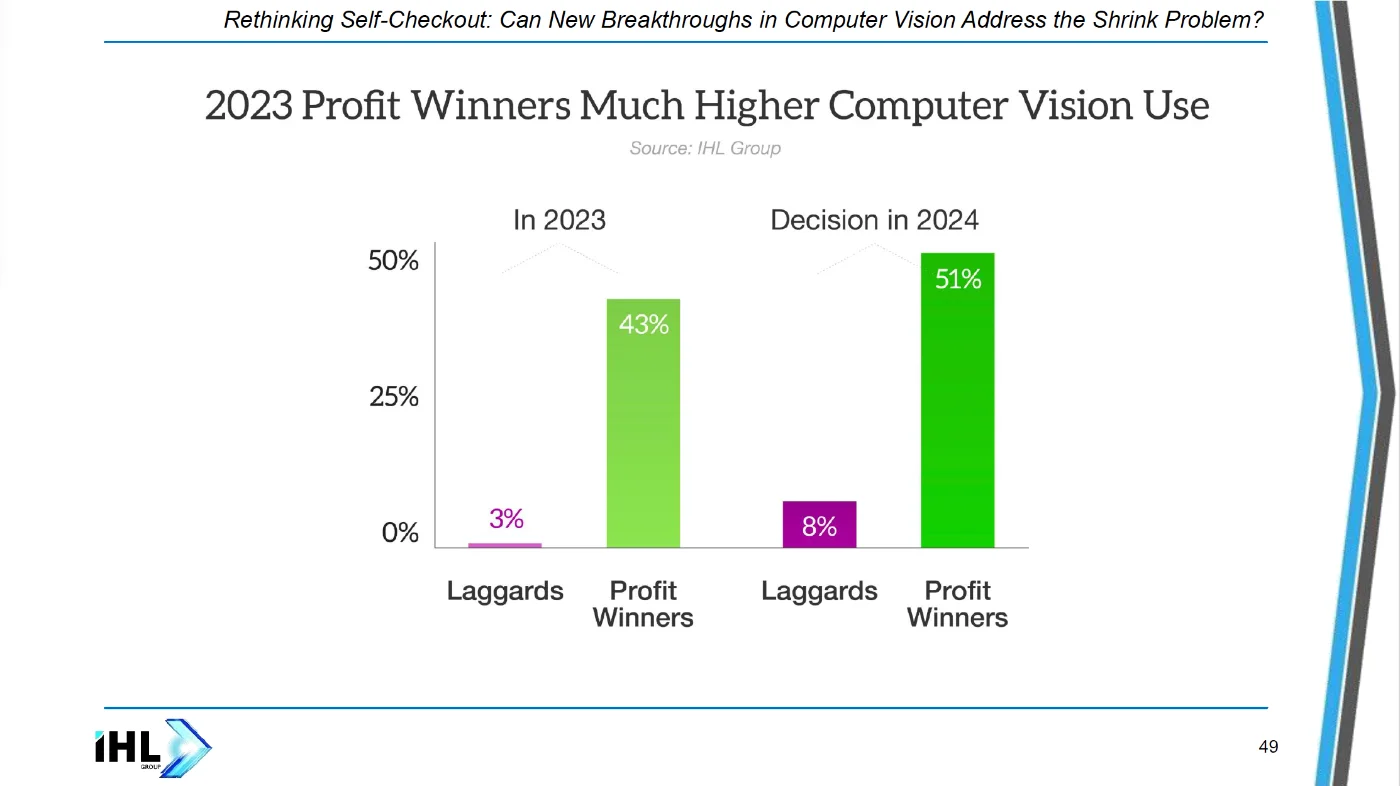

55 percent of retailers plan to utilize computer vision by the end of 24, up from 24 percent in 2023. Why? Because it works. It’s also a deterrent but it’s not perfect. And we’re going to talk about that. Our winners were 33 times more likely to be using computer vision in 2023 already.

Looking at 24, they’re also 3.3 times more likely to be deploying new computer vision installs in 2024. So there’s certainly a belief in the technology there. When you look at the profit winners, it’s a little less. I think we’re looking at about, 15 times more likely that the profit winners are using computer vision today.

And here you’re looking at close to 5 times more likely that the profit winners are going to deploy computer vision in 2024.

Retail’s use cases for computer vision

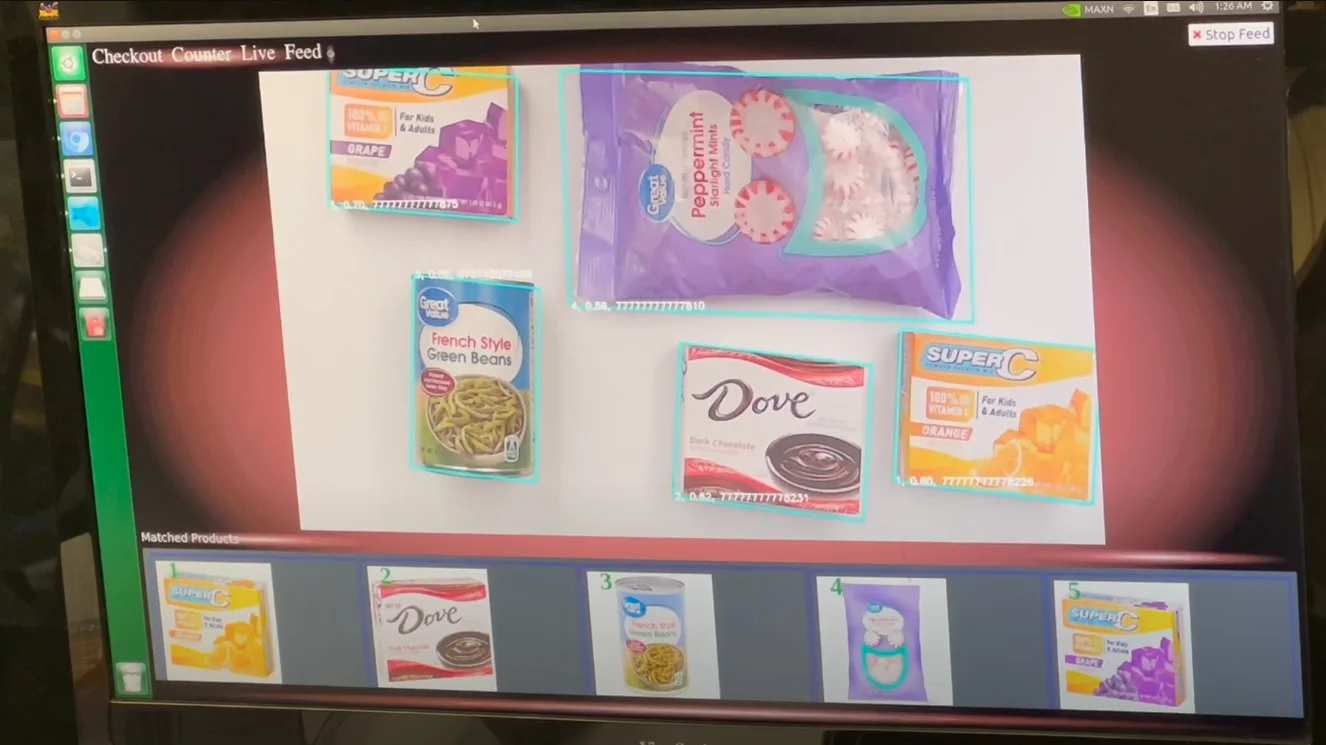

[00:23:04] Greg Buzek: So how all the different use cases for computer vision out there, product recognition, identifying and tracking the products in real time certainly, and loss prevention. Those are a big thing when you’re talking about self checkout, which we’re going to be talking about it in great detail here. Shelf analytics, though: monitoring the shelf conditions and detect issues with out of stocks, misplaced items, those sort of things is a big deal.

Often forgot about is the back of the house operations. What’s going on in the back of the store? What’s happening with the inventory? Where are products that are not on the shelf? But where are they in the back office there? But also what’s happening at your loading dock? Do you have products going out the loading dock there because of theft out the back door rather than out the front door or the side doors that you have elsewhere?

Analytics. Analyzing customer behaviors and their preference for solutions, dwell time, their heat maps, et cetera. Then you certainly your checkout systems, whether that’s self checkout whether that’s mobile checkout by an associate or whether that’s the consumer checking out by themselves on their own mobile device, all of those things require an eye in the sky, so to speak, to help prevent fraud in that environment.

And then loss prevention there detect and prevent theft there. Most often you see it in the self checkout, but it’s certainly been in the staff lanes for years. So with that, I am going to bring in Stef, and Stef is going to come back and talk, take the next stuff and talk about UltronAI and what they’re doing and what they’re seeing in the market.

The need for computer vision in retail

[00:24:39] Stefanos Damianakis: Great. Thank you, Greg. So I’ll start with just an overview of numbers that people are likely familiar with: the shrink problem for retail is now over 100 million and annually and growing, and it’s gotten so big that action is needed. Retailers are taking action to try to address it.

The flip side of this coin, in addition to shrink, is customer experience. There’s a lot of headlines as Greg alluded to that people are unhappy. Customers are unhappy with the experience that they’re getting. They’re complaining about self checkout. They’re complaining about checkout.

And the user experience is an important component that retailers are looking to solve. The self checkout, if you read the news, it is that a reckoning is coming. Something has to give because of the current generation of self checkout systems need to be improved. And focusing on those two components right now, the checkout and the shrink problem, retail is going to need to evolve to address these challenges.

What they’re using today to solve these problems has to evolve to something better so that we can get shrink to reduce from this incredibly high number and improve the user experience, the customer experience.

The shortcomings of computer vision in retail today

[00:25:47] Stefanos Damianakis: But aligned with retail’s need to evolve, to address these challenges, it actually turns out that computer vision also needs to evolve and improve in order to help retail address those and the other challenges, the needs that Greg mentioned earlier, which we’ll talk about a little bit.

Why does computer vision need to actually evolve? Because I think what we have today is good, but it needs to get better.

There are challenges when you’re implementing computer vision in retail. Things like occlusion of products where they’re not seen perfectly or they’re not perfectly positioned. The lighting conditions in stores are not the same as the lighting conditions in a test environment, being able to discern fine grained details when you’re looking, whether it’s a product or a person or a cart, depending on the business use case. The operational overhead of enrolling products has to be minimized so that it doesn’t take doesn’t take weeks of effort in order to upload the systems, the computer vision systems.

Another issue with computer vision systems is, the product catalog size as it gets bigger, it tends to make the AI slower, so it’s slower to respond and the accuracy decreases because the complicated, high dimensional search that it does becomes harder to find things and the accuracy and the speed are affected.

Of course, scaling to a large number of stores for the larger retail chains is also a concern. And I think the big one here is the solution cost as well, right? You can’t, everyone would love to have an Amazon Go store. But that’s prohibitively expensive and not pragmatic. And so how do you deliver on these requirements to help retailers address their needs while at the same time keeping the solution cost low, which means keeping the camera counts low, keeping the compute required to do computer vision low, keeping the network requirement low.

So how do you keep all of these costs that can potentially make a computer vision solution not profitable for retailers? We’ll skip the other ones and move on to the next point. So what, at the end of the day, what retailers looking for, what they want is they want eyes on the store operations.

And the reason that they want these eyes on is not because the goal is a surveillance state, a big brother watching, is they want to understand what is happening in their stores in order for them to better serve their customers, improve their profitability, improve their operations. So there’s this need for eyes on what’s happening in the stores, there’s business reasons, valid business reasons for this.

And it’s not just about improving self checkout and even the checkout systems and shrink prevention, cart tracking, the stuff that Greg mentioned. All of these benefit from computer vision systems that can be deployed in stores with the right pragmatic approach that we have, constraints that make business sense that keep costs in check and actually deliver accuracy and performance that’s needed. Because if your computer vision system lacks accuracy in whatever task you need it to do, then it’s going to create more problems than the problems it’s going to solve. So I think accuracy is a big part of it.

I think the key part of this is, as Peter Drucker mentioned or is known to have said, that you can’t improve what you don’t measure. So I think that’s a big part of what computer vision enables, right? It enables measuring things that are not hard that are hard to measure if you don’t have eyes on what’s going on in your store, and I think that’s a big part of it.

As much as I love computer vision, and we do computer vision, we live and breathe computer vision. I will be the first to say that computer vision is not a silver bullet. I see it more as an essential technology for retailers that can address a variety of different business needs, but it is certainly not the silver bullet that can magically solve these hard problems on its own.

I think it needs to be part of a solution that addresses those needs. And it is a key part, I think enabling technology for retailers.

UltronAI’s solution and approach

[00:29:41] Stefanos Damianakis: And finally, a little bit about our company. Ultron AI is focused on building computer vision software only, of course, and our software is designed to the various use cases that we talked about for retailers, including identifying products, including identifying shrink and we work directly with retailers that want to integrate our software into their environments, but we also work with solution providers to embed our engines into their products that serve the retail market. So we have this two prong approach on how to deliver our software to the retail industry. It is a technology that’s based on 60 patents have been issued on this technology.

It comes with 20 years of research and development and military grade AI work that was done to identify, I would say facial recognition as a starting point for us that has been now adapted to identifying products, identifying carts, identifying shrink, identifying users as they walk through the retail store. And our claim to fame is that we have achieved near human level accuracy, even in the poor lighting conditions and obscure products, as we mentioned earlier in the real world of the retail store. That’s a quick summary of our company.

And we look forward to hearing from anyone who would like to see more, there’s a little demo button up there. If you’re interested in seeing a demo, please feel free to schedule some time with us. With that, I’ll pass it back to Greg.

Greg Buzek: All right. Thanks, Stef. And the thing, one thing I should have told everybody up front, the difference between Ultron and say some other companies that we’ve done webinars with is they’re open to talking to vendors, to press, to you To retailers directly and what they do.

So if you’re a vendor and think you’re excluded from seeing a demo by all means, you can jump in and schedule a demo and learn what they do and how they do that with what they’re doing. So thanks, Stef. I appreciate. Appreciate that.

Computer vision within retail’s tech ecosystem

[00:31:37] Greg Buzek: So picking up, let’s talk about a little bit deeper in the data when it comes to computer vision and what it’s saying.

The main thing here is that it’s synergistic with other technologies in the store. There are very strong synergies that we’re seeing with point of sale and self checkout for obvious reasons there. But it’s the consumer mobile checkout. And the retailers own mobile point of sale as well. Certainly all your loss prevention and safety systems, not only just in the lane, but also through in the store, slip and falls as well as other things.

So it’s not just the CCTV, it’s actually processing that data in that environment. Edge computing, your trade management and compliance is that special trade allowance. Is that on the end cap like it’s supposed to be? And then certainly, as we had in one of our last webinars, the great synergies with RFID in your inventory systems there as well.

So let’s talk about that checkout side. So this is a priorities of looking about what’s going on and what’s the plan going to be doing in the next year there and in self checkout here. 51 percent more likely to be using the computer vision if the refreshing point of sale, almost 300 percent more likely if they are deploying self checkout and a whopping almost 800 or eight times more likely to be deploying computer vision if the store is deploying mobile point of sale in that environment from their own associates, which I felt was fascinating that we’re literally looking and it could be that we’ve got more already on self checkout than we have on store PoS.

I didn’t look at that. But to think that we’re two and a half, almost yeah, two and a half times more likely to deploy self check or excuse me computer vision when we give our associates checkout devices rather than our consumers, allowing them to check out on their own.

Computer vision. It’s not quite one to one. There are the people that are using computer vision today are 10 times more likely to also be using edge computing today. Just a massive alignment. There makes total sense because the networks can’t handle the amount of volume that are coming through them. So you’ve got to understand where, what is the edge of the device?

Is it a Backend edge server there. Or is it in the access point alone? How do you do that? Each solution has its own way of doing that in that processing for things. So edge computing is huge.

The mobile checkout from the consumers. This is interesting that 93 percent of the companies that plan to let customers shop with their own devices are planning to deploy computer vision as a result, it’s that trust, but verify type of situation there because the data though, when you allow the customers to check out on their own, the increase in sales is huge. It is literally about 4 to 5 times that of those that don’t allow to do that.

The sales growth numbers there, but you do see a major increase in theft. Wegmans allowed everybody to check out on their own phone there, and they ended up pulling the entire things because the amount of theft that they got through that. And it’s not a panacea. You have to have some checks and balances when you allow customers to check out.

My favorite is Sam’s going to Sam’s today with the scan and go is still my favorite place to go shop because I’m in and out very quickly on my own there. We mentioned in a previous webinar: huge alignments with computer vision and RFID, those making computer vision decisions are 14 times more likely to already be using RFID today.

The sales winners are 760 percent more likely to already be using RFID, and they’re 41 times more likely to be already using RFID in the fast moving consumer goods segments that we used here for our sample for this research. Thank you very much.

Hiring talent to build and support computer vision

[00:35:43] Greg Buzek: It’s last one here. Or this is not last one, but one of the last ones here is a lot of times we put these technologies in and we really haven’t thought about the the infrastructure challenges that come along with those. And this is where there’s a need for not only data management challenges there, but also your talent. There is a huge talent war going on for anybody that’s an AI or computer vision there. But it’s not just in the development and getting the people to development. You have to have people that can support this technology on the back end as well. And that is often forgotten.

I’m going to be doing a soon going to be doing a presentation for a construction group and that gets into the next two, which is related to the power, the networking in the airflow. Do you have a proper infrastructure there to support what’s going on with technologies like computer vision or even AI being used at the store level?

Don’t forget that infrastructure. That is a big part of what’s going on here. The other thing is talent. As we mentioned, acquiring the talent as well as finding people that can support that talent. So overall this is a higher pain point, 174 percent higher pain point than others when it comes to acquiring talent, and then 168 percent specifically on computer vision.

When you get to it’s the facial recognition side of it, 19 times higher pain point to find the people to be able to do it. And then 140 percent higher pain point when it comes to doing that. Stef, you had some things you wanted to add into this.

Stefanos Damianakis: Absolutely. I can attest that this is a very real challenge for Anyone building computer vision systems. And I think I think what it has done is skyrocketed salaries for compensation. I won’t just say salaries compensation for computer vision talent. A lot of it is driven by the big players who have large investments like Microsoft, Google, and Meta, and they are driving up the total compensation of computer vision expertise.

Which just makes it a tough operating environment for everyone. But I can see, I can, I’ll agree firsthand with these numbers that it is the talent component that should not be underestimated because it’s it is a real problem today in today’s market.

Greg Buzek: So I just, as a quick aside here, cause we’ve got the time to do it here.

I just threw in the chat there recommended podcasts for everybody called the BG squared podcast. This is a very big thing that’s happening. So there’s two big things that are happening that is tough for smaller software companies right now. Number one. Is they have to take all of the expense in the year.

It’s done right now based on the way the tax law is, which means you can’t depreciate a labor or the cost of a project over multiple years anymore. You have to have revenue to offset that R&D expense. That’s a big deal. Right now that’s really causing headaches for small software companies.

Number two though, is how these larger companies are literally doing compensation packages here. It’s not unlike what we’ve seen with some of the things that we’ve seen with AI, with some of these AI tools. In some of these packages where, Hey, look, Microsoft just made a 10 billion investment into open AI, but about 9 billion of that or more has to be used as credits back on Microsoft system.

So they not only get a portion of this company in case they go pay for it. They go public, they get the revenue coming back of their own money going coming back to them in the sense of credits. That’s the same kind of thing that’s been happening with some of these larger companies like the Googles, like the Microsoft and others.

When it comes to how do they compensate some of these higher earners in AI and they’re getting The equivalent of options, so to speak for a lot of stock to take these different positions as part of this talent war. So this is a big deal, but highly recommend that podcast, by the way, it’s the best podcast I, I listened to. It comes out every two weeks or so with Brad Gerstner and Bill Gurley.

The challenge of network bandwidth and its impact on computer vision adoption

[00:40:04] Greg Buzek: So last one here slides network bandwidth is you can never have enough storage and never have enough bandwidth. This is a big deal when we have any technology in the store particularly the highest sales growth people there, but ironically your lowest performers as well.

This is universal. That network bandwidth and the availability of bandwidth is a huge issue, and it’s particularly huge when it comes to computer vision if you’re pumping any video over that network there. Always keep that in mind.

What’s next for computer vision in retail?

[00:40:40] Greg Buzek: So the road ahead, areas for improvement and this is where staff has got a lot to to be able to jump into, but the need for advanced algorithms here to do a lot better and a lot more efficient algorithms, what’s going on, and this next point, I want to throw it out to staff there.

If you want to turn your microphone on there to literally how important it is to invest in a retail foundational model. So we’re not using a general purpose model that we’re trying to add on. With retail stuff, but how we get to a more focused retail model. So it’s more efficient on less compute.

Stefanos Damianakis: Yeah. I think that’s an important point, and that’s the path we’ve taken. Of course, there’s many different paths available to companies, but ours is one of building a foundation model from scratch. And I think the advantage of doing that over incrementally adapting an existing model from another vendor is that you do get the ability to adapt it and tune it for the specific retail use cases that you’re looking for.

So it gives you better performance as well because it’s now tuned for retail and not a general purpose model. And I think that’s some of the advantages of it. Of course, the disadvantage is, building and training models add complexity. You need GPU hardware, cluster to do the training, the evaluation of course can be done on edge devices so it’s a lot more cost effective. But the actual building of the model requires an investment up front in order to get the benefits, which is, usual challenges that decisions company make companies make with investments in ROI.

Greg Buzek: And then there’s always a data privacy and security, whether it’s a privacy of people when you’re using facial recognition but also how do you use that data there and what’s going on. Anybody’s paid attention to the news and looking at TikTok and what’s going on with TikTok. And the government there certainly understands this issue of privacy and security piece of it, but it’s something that retailers have to deal with there.

And then we’ve got futures coming along that could be massive improvements in what’s going on, certainly the AI improvements that seem to be coming every single day. It’s hard to keep up with the neural network improvements. And then down the line, quantum computing is coming faster than we think, which is going to allow us to manage those algorithms and run those algorithms much more effectively.

So with that’s the end of our core slides.

Q&A

[00:43:05] Greg Buzek: We’ve got time. We got about 11 minutes for Q and a. So we invite you to to ,give your questions there. And also Also wanted to throw up here. Here’s how you can get the slides and the report with that. I threw that up there while we’re doing that.

So if you’ve got questions, we’re going to turn the cameras back on, and Lee,what do you got there?

Lee Holman: All right. Right off the bat, this is for both of you. Which use cases are you seeing more interest in for computer vision? Loss prevention, consumer, customer experience, inventory management.

Greg Buzek: Go ahead, Stef.

Stefanos Damianakis: We’re seeing both, actually. I think loss prevention and checkout systems. Enhancing checkout systems with computer vision is very high on the list. So I think those are the two. We’re looking at the two top ones from our experience in our recent conversations, but we’re also looking at shelf monitoring planogram verification, and other shelf related inventory management related issues,

Lee Holman: Visibility overall.

Greg Buzek: Yeah it’s all of the above. It’s like asking the same question, where do you see AI impacting retail? It’s everywhere. Up and down the income statement and the balance sheet.

Other than that, nowhere. There are places where it’s used more effectively. And and I think one of the things that we talked about in a previous webinar is computer vision generally is not the complete solution there. It’s got to be partnered with other items there. And if it’s an inventory, Now we’re talking about being integrated fully with RFID so that you’re taking some of the challenges that you have with products being blocked or depth of field issues with computer vision that you’re able to get that with RFID.

Second there is the fact that you have this opportunity to use all these other technologies to enhance the data and what’s coming. Coming on down the pike. I think those are all, but it’s regarded there. Loss prevention is the biggest need right now. We shared all those sales numbers and when sales are growing like crazy, you would have to be an idiot as a retailer to go out of business in 21 and 22.

In early 22 because of what was happening in the amount of money the government handed out that consumers were spending there it’s a much tougher now when you’re and so people are starting to look at those losses because that increased sales covered a multitude of sins and it’s back to operational excellent in reducing that theft, which plays right into computer vision.

Lee Holman: Okay. This one also for both of you. How does the recent pullback of Amazon for the just walk out technology impact industry acceptance of computer vision

Greg Buzek: for my view? Not much. I think it’s related to the size. In the beginning. To be clear, the just walk out technology is not going away.

It’s just the scalability at the larger stores as an only checkout condition is what’s gone away. Amazon hasn’t gotten rid of the whole department or anything like that. You still going to be able to go into your smaller stores and do that. And that’s really where it’s an every store. Is type environment is the only checkout option in a store.

It’s going to be a small format. The cost and the efficiency is just not there to do large format stores in that environment. But in terms of the credibility of the technology, I don’t think it has anything to do with that.

Stefanos Damianakis: Yeah, I would agree. I think it’s I think it’s a great experiment. I’m sure that there was a lot of learnings from that experiment.

And it shows us the direction that we’re heading, but we’re not quite there yet. I think the technology still needs to mature in advance. The prices have to come down for the compute hardware and the vision hardware. And and I think that is certainly a trajectory that we’re heading towards, but I think it’s still many years out before we can, before that’s affordable and pragmatic for retailers.

Lee Holman: And you still got to pay the people in the back office that are actually looking at the screens.

Stefanos Damianakis: You got to pick if it’s still human in the loop. I think that’s the big problem from a cost perspective as well. Having human in the loop limits the ability to automate the process, which You know, is what the goal is.

Lee Holman: Okay. Stef, this one’s for you. What’s the best approach in terms of a build versus buy decision for computer vision?

Stefanos Damianakis: Yeah, that’s a great question. And a tough one, actually, because there’s so many variables that come into that decision. So for me, First and foremost it’s is the company ready to make that investment to do the, to do the building and decide what exactly which components, because, computer vision has as many stages, what stage of the computer vision pipeline do they want to build?

What stage do they want to buy? And is it core to the future of the company, right? Is the component, if they’re building cars, for example, do you want to also build the engine or do you want to buy the engine of the nice car that you’re building just to have a car analogy? So if a retailer is building a self checkout system which is, can be very complicated and have many points of integration, are they interested in focusing their effort on the self checkout system and and then just reusing an existing or buying the component that does the computer vision, right?

Or do they need to, do they feel compelled to build their own computer vision system and have the infrastructure to do that? Also, the people needed to do that. The expertise needed to do that. So it really is about what the core competency of the company is and what is the longterm value for them.

Of building up this particular skill set, and how does it fit to their product planning road map? And what’s the priority of that? So it’s, it’s an important but hard question to answer that becomes specific to each company as they allocate resources correctly, I

Greg Buzek: think, or optimally. Sure, I know some people thrown in the chat having some issues downloading the slides go through the checkout process.

I think I might have had it still on private. Yeah. Rather than so that people didn’t get access to it yet. It should be working. Now. We will send it out. Make sure that’s all fixed before we when we send out the note after this. So I apologize for that. So

Lee Holman: Greg this one’s for you. Can you talk about the impact of fuel prices?

On the retail industry right now, especially the ripple effect.

Greg Buzek: Yeah. I think the bigger question comes as to how long are the prices gonna stay up. There we’re right at where we were last year. I think the bigger issue is the longer term nature of the, of inflation overall. We’ve had these shocks to the system with things that are one time charges or two times a year charges with the insurance there that’s impacting things, but it’s not a huge driver at the moment of being considerably higher than we were a year ago.

And I expect it to come down because I think as people are facing some of the tighter things there. It’ll come to play. But that’s my view on it.

Lee Holman: And there’s not a whole lot that’s, sticky downwards, so always increasing this real sticky, trying to come down.

Exactly. Exactly. One’s this one’s also for both of you. Can you ever see a time when, as a loyalty member, I could walk up to a checkout, be able to download any active digital coupons for what’s in my basket.

Greg Buzek: Have you been presented with that use case there, Stef?

Stefanos Damianakis: No, we haven’t been presented with that use case, but I think when we look at the infrastructure we have and how we’ve integrated with existing systems, it’s an integration question, right? Because once you identify what’s in the cart, as long as you have access to the data set of coupons which is in the database somewhere, And you can query that database.

You can come back and present the coupons that are eligible for the particular items in your cart. So it really is from a computer vision perspective straightforward. The trick comes from the integration perspective, of course, at the checkout system so that the checkout system has access to the coupon database and is able to query it and bring back the results.

Greg Buzek: Yeah, that really gets to an ethical situation for that retailer to is, “hey, you haven’t clipped the coupon. There’s a coupon here for a dollar off.” Your cashier will tell you that sort of thing. The app may or may not. mobile shopping there, you may have them clipped in and it’ll automatically do it, or it may recognize what you’ve got because you’ve scanned it yourself.

That would be,

Stefanos Damianakis: but today when you have a loyalty card and you go to the grocery store it automatically applies whatever you bought in your purchase. It automatically applies any discounts or coupons that they.

Greg Buzek: So you don’t right now in most retailers, you have to accept those coupons there.

For instance, when I go to Kroger right now, I have to clip coupons. If it’s a, if it’s a mobile coupon, I have to clip that first before I run the transaction. Wouldn’t it be great if it literally just saw all my coupons and just took all those.

Stefanos Damianakis: I think there’s a cultural part of this too which is wasn’t there a retailer that a few years ago got rid of, was it Sears or something?

They got rid of coupons and just put lower prices and then people complained because they like the hunt and the game of finding the coupons and they find it entertaining. And then they basically brought coupons back and changed the pricing to have people have to find it’s an interesting social component to this. I think.

Lee Holman: Right. That would be a great technology for Harbor Freight.

Stefanos Damianakis: Yeah.

Lee Holman: Yeah. One more question here. What is the shopper acceptance like for new technologies like computer vision RFID?

Stefanos Damianakis: I mean, I guess it depends how it gets deployed in the user experience, right? We can see from self checkout that people are often unhappy with it. At least the current iteration of the, of self checkout. And so I think acceptance comes with user experience. If you can it’s the, you have to look at the whole, right? Not at the part. If the whole solution provides a positive user experience, I think the acceptance will be high. In other words, to have a positive user experience means It has to be straightforward, easy to use, works really well, saves time, reduces friction. If you get all of those right in the solution, then I think the user, the adoption will be high.

If it becomes a high friction solution. Then I think people will complain as they are doing right now. So I think it’s all about how the entire solution is developed and produced. Greg?

Greg Buzek: No, I think you’re right. I think right now the compute required to do this effectively by having a general purpose model that we add to is too heavy for the technology that we’ve got to be able to do it, which is creating this customer experience.

There it’s a little too slow for what they want there and want to be able to do. And that’s where the enhancement of having a retail foundational model that’s tuned and doesn’t have that additional overhead as well as the compute enhancements that we’re getting with some of these neural processors that are coming out here in the next three months are really going to add to the customer acceptance of the technology.

Stefanos Damianakis: Yeah. Can we answer one more? I think Srinamath asked a great question. But lost detection and lost prevention. Sure. And I think her question is says, however, lost prevention is a business decision made by vendors.

So for example, if you detect a self checkout fraud occurring, do you want to actively intervene or try to prevent it while risking confrontation with the perpetrator? Greg, why don’t you take a first stab and then I’ll jump in.

Greg Buzek: I think the, I think that depends on your whole philosophy and what’s going on.

With things, are you better off just using the CCTV and validating who that person is and stopping them the next time they come into any of your stores because you don’t have the personnel or you don’t have the policy to to approach that person. If all you’ve got is an older lady at checking receipts at the exit, There and that’s your security then it obviously doesn’t make any sense to do that.

But if you have an armed police officer That is standing there. Then you may want to confront that’s going to be based on what your thing, or you may want to go to the old surface service merchandise model in there where all your merchandise comes after you pay for it type of thing. Every place is a little bit different.

And I think that most people right now, unfortunately, in my mind are not challenging anybody there. And that’s why this facial recognition piece is so important because you want to catch them the next time. They come into your environment.

Stefanos Damianakis: Yeah. And as, as Matthew points out in the chat, this really is an issue with the policy of the retailer more than the technology, right?

It’s the technology tells you that something happened, right? This is what’s happening right now. The retailer’s policy to say, okay, when that happens, how do we react? And and as you said, Greg, it depends on the resources, how the retailers set up but you’re right. Retailers today, as we can see from the news reports, just don’t confront theft.

They just let them walk out. And in fact, there was a story about I think it was a Walmart employee that tried to stop someone who was stealing and they got fired for it. Great policy.

Greg Buzek: Yeah. Best Buy and Home Depot have all both had that. I believe so. Yeah. All right. So we’ve got more questions here.

We’re going to stop it right now. We’ll send the questions out and we’ll try to get you answers to those questions offline for things. But once again, thank you so much for taking your time today. Please give us feedback. I think the download and the slides and everything works now. So if you’ve got those in your cart, they should they should work if you try it again and we appreciate you.

So we’ll send out the slides and a note as a followup as a thank you. Thank you. Take care.

Stefanos Damianakis: Thanks.

Lee Holman: Take care, guys. Thanks, Greg. Thanks, Stef.